Overview ofSingapore GST Module

The Singapore Tax Report is an add-on module for Sage Intacct, developed to support tax compliance in line with Singapore’s legislation. It primarily addresses Goods and Services Tax (GST) requirements as mandated by the Inland Revenue Authority of Singapore (IRAS). GST in Singapore is a 9% Value-Added Tax (VAT) applied to imports and most local supplies of goods and services. Certain supplies are exempt, such as the sale and lease of residential properties, financial services, and investment in precious metals. Exports and international services are zero-rated. Additionally, GST on public healthcare services is absorbed by the government.

In the following sections, we will guide you through the setup and usage of the Singapore Tax Report module within Sage Intacct.

Master Setup Requirements

There are certain master setup requirements that need to be configured so that the Singapore tax report module can work effectively. These settings include setups at the company level.

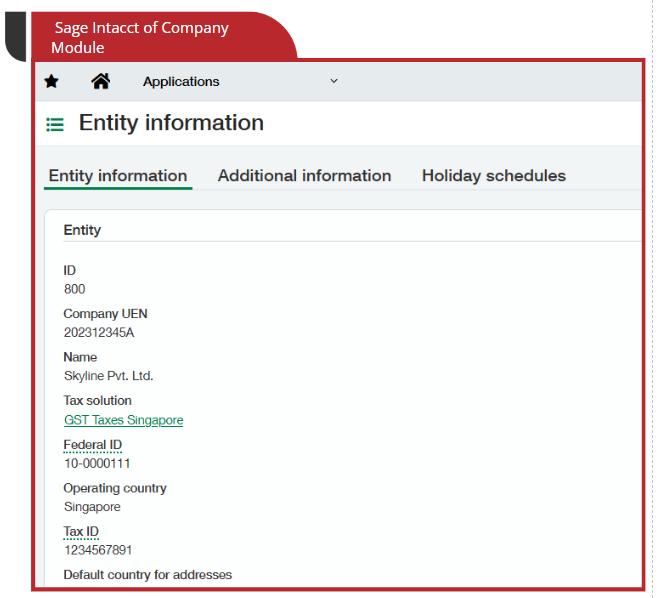

1) Settings in the Company module

In the Company Module under the entity screen, check that there is information in the following required fields:

- ‘Name’ field from the entity screen under the “Entity Information” Tab.

- Company UEN field from the “Additional Information” Tab

- Tax ID field from the entity screen under the “Entity Information” Tab.

2) Settings in Vendor master under Accounts Payables.

To open the vendor master screen, navigate to the Accounts Payable module ➔ Vendors screen. We need to input the information as below.

- We need to verify if the name of the vendor is present in the Vendor master screen under the Vendor Tab ‘Name’ field.

- UEN needs to be captured in the ‘Supplier UEN’ custom field in the Vendor Tab.

- User needs to enter the Permit Number in the vendor master screen ➔ Contact list Tab ➔ “Pay-to contact” field (custom field will be added for the Permit Number in the contract information screen) in case of Import/Export transactions.

3) Settings in Customer master under Accounts Receivable

To open the vendor master screen, navigate to the Accounts Receivable module ➔ Customers screen. We need to input the information as below.

- We need to verify that the name of the Customer is present in the Customer master screen under the Customer Tab ‘Name’ field

- UEN needs to be captured in the ‘Customer UEN’ custom field in the Customer Tab.

Singapore Tax setup

We need to configure the Taxes module in Sage Intacct in order to deduct the Tax on the transactions. Tax configuration is as explained below.

1) Tax Solution – Tax solution is used to define the tax configuration, which is then used to assign to the specific entity. Create a new Tax Solution for the Singapore taxes from the path: Taxes module ➔ Tax Solutions screen.

2) Contact Tax Groups – Once we create the Tax solution, we move on with the creation of the Singapore Contact Tax Group, where we define three tax groups, i.e. Taxable, Non-taxable, and Exempt.

3) Item Tax Group – After creation of Contact Tax Group, we need to create the Item Tax Group, which will list all the tax codes defined for the Singapore taxation, such as zero-rated supply, standard-rated supply, etc.

4) Input/ Output Tax Details – In Tax details, we need to define all the taxes along with GL accounts for expenses, liability and rates and also define under which Tax solution these Tax details fall. If a particular Tax detail is applicable under RCM, you need to tick the check box “Is reverse charge”.

5) Input/ Output schedules – Here we map the Input/ Output Tax Details as created in step 4, which is then mapped in the Customer/Vendor master.

6) Input/ Output schedule map – Here, we link all the above steps mentioned above in the Input/ Output schedule map.

Singapore Tax Codes Creation and Mapping

To ensure accurate reporting and compliance with IRAS regulations, businesses use standardised GST tax codes to classify different types of transactions. These codes help distinguish between standard-rated, zero-rated, exempt, and out-of-scope supplies. Proper use of GST tax codes is essential for correct invoicing, GST return filing, and claiming input tax.

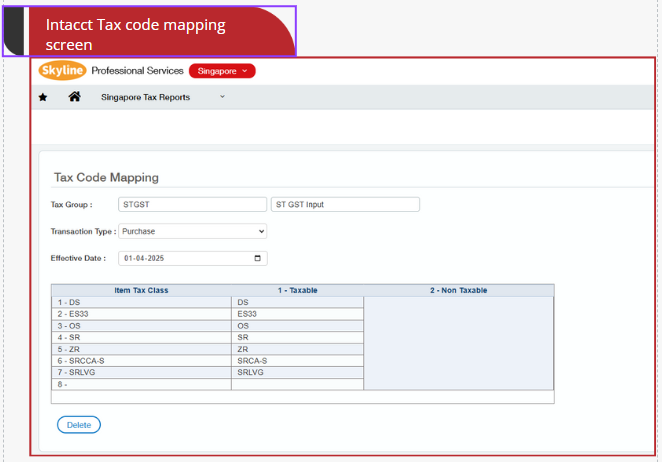

We create standard codes applicable for Singapore tax in the Singapore tax reporting module; these tax codes can then be mapped to input/output tax details ID to help us derive the F5/F8 reports.

To map Singapore Tax codes to input/output tax details ID, navigate to the Singapore tax report module ➔ Tax code mapping.

Here, select the transaction type (Sales or Purchase), then select the effective date for which the tax codes need to be mapped.

The effective date is the date on which a new tax rate or regulation legally comes into force. For example, the 9% GST rate became effective on 1 January 2024.

If any revision happens in the existing taxes, we need to add a new effective date to reflect the changes in tax codes.

After selecting the effective date, we need to map the tax codes to the Input/output tax detail ID in the Detail table.

The tax code mapping screen shows the tax properties to correctly generate Singapore tax reports and tax IAF files required by IRAS.

Effective Date | Tax Code | Description | Transaction Type | Rate |

|---|---|---|---|---|

20140101 | BL | Disallowed Expenses | Purchase | 9.00% |

20140101 | DS | Deemed Supply | Sales | 9.00% |

20140101 | EP | Exempt Purchase | Purchase | 0.00% |

20140101 | ES33 | Regulation 33 Exempt Supplies | Sales | 0.00% |

20140101 | ESN33 | Non-Regulation 33 Exempt Supplies | Sales | 0.00% |

20140101 | IGDS | Imports under the Import GST Deferment Scheme | Purchase | 9.00% |

20140101 | IM | Imports | Purchase | 9.00% |

20140101 | ME | Imports under a Special Scheme | Purchase | 0.00% |

20140101 | NR | Purchases from Non-GST Registered Suppliers | Purchase | 0.00% |

20140101 | OP | Out-of-Scope Purchase | Purchase | 0.00% |

20140101 | OS | Out-of-Scope Supply | Sales | 0.00% |

20140101 | SR | Standard-Rated | Sales | 9.00% |

20140101 | TX | Standard-Rated | Purchase | 9.00% |

20140101 | TX-ESS | Standard-rated purchases directly attributable to Regulation 33 exempt supplies | Purchase | 9.00% |

20140101 | TX-N33 | Standard-rated purchases directly attributable to Non-Regulation 33 exempt supplies | Purchase | 9.00% |

20140101 | TX-RE | Residual input tax – Purchases from GST-registered suppliers | Purchase | 9.00% |

20140101 | ZP | Zero-Rated | Purchase | 0.00% |

20140101 | ZR | Zero-Rated | Sales | 0.00% |

20190101 | SRCA-C | Customer Accounting supply made by the customer on supplier’s behalf | Sales | 9.00% |

20190101 | SRCA-S | Customer Accounting supply made by the supplier | Sales | 0.00% |

20190101 | TXCA | Standard-Rated purchase of prescribed goods subject to Customer Accounting | Purchase | 9.00% |

20230101 | IM-ESS | Imports of goods directly attributable to Regulation 33 exempt supplies | Purchase | 9.00% |

20230101 | IM-N33 | Imports of goods directly attributable to Non-Regulation 33 exempt supplies | Purchase | 9.00% |

20230101 | IM-RE | Residual input tax – Imports of goods | Purchase | 9.00% |

20230101 | SRLVG | Own supply of LVG | Sales | 9.00% |

20230101 | SROVR-LVG | Supply of LVG accountable by the redeliverer or electronic marketplace on behalf of third-party suppliers | Sales | 9.00% |

20230101 | SROVR-RS | Supply of remote services accountable by the electronic marketplace under the Overseas Vendor Registration Regime | Sales | 9.00% |

20230101 | SRRC | Imported services and LVG accountable by the customer under the reverse charge mechanism | Sales | 9.00% |

20230101 | TXRC-ESS | Imported services and LVG directly attributable to Regulation 33 exempt supplies | Purchase | 9.00% |

20230101 | TXRC-N33 | Imported services and LVG directly attributable to Non-Regulation 33 exempt supplies | Purchase | 9.00% |

20230101 | TXRC-RE | Residual input tax – Imported services and LVG | Purchase | 9.00% |

20230101 | TXRC-TS | Imported services and LVG directly attributable to the making of taxable supplies | Purchase | 9.00% |

Singapore tax GST reports

F5/F8 Reports

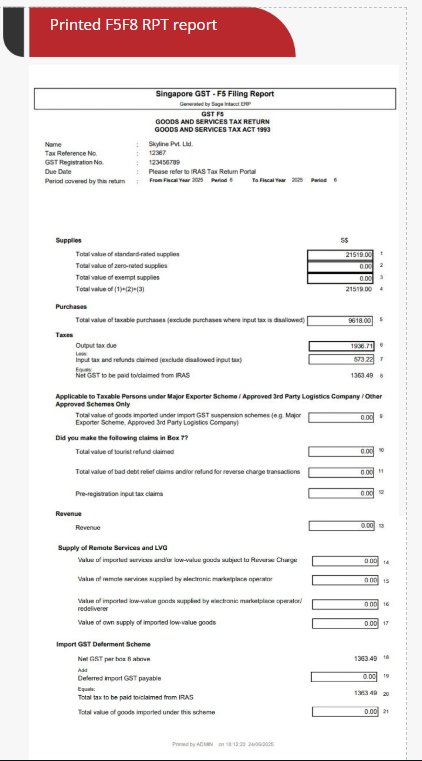

As we know, the F5 report is the standard GST return that GST-registered businesses in Singapore must file quarterly or monthly to declare output and input tax.

If you wish to cancel the GST registration of your organisation, then you may fill out the GST F8 report to file the Final GST returns that you have held on the last day of your GST registration.

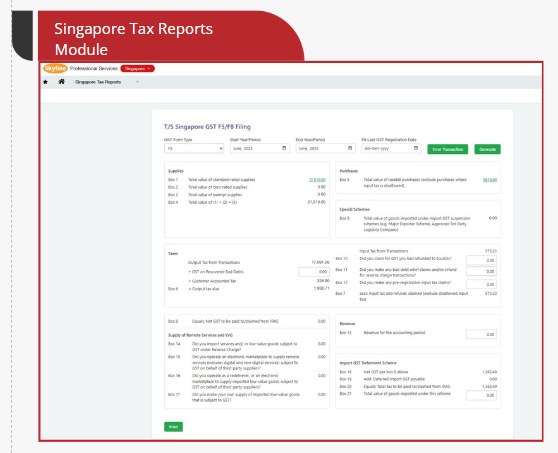

To generate the F5/F8 report, you may navigate to Singapore tax reports ➔ GST F5/F8 screen.

In this screen, please select the GST form type, either F5 or F8. Then you must select the period criteria for which you need to file the GST returns (monthly or quarterly). Then you need to click on the ‘Generate’ button so that all the data for the specified period criteria will be fetched. If there are any errors while fetching the data, it will show in the ‘error transaction’ button.

After generating the report, it will give us sales and purchase-wise data along with reverse charge transactions, with some of the boxes being auto-populated based on the tax code mapping provided. There will be certain manual input boxes as well, which will help to finalise the F5/F8 report.

Once you have entered the required data, click on the ‘Print’ button to generate the F5/F8 report format.

Singapore Tax IAF file

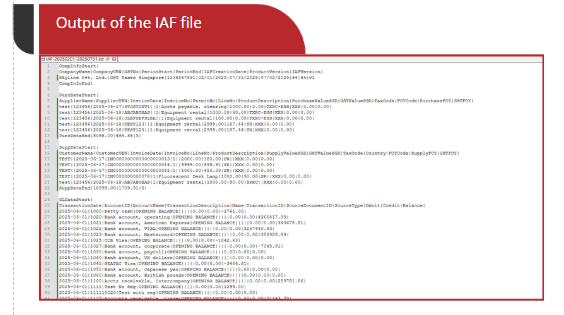

The IAF (IRAS Audit File) is a standardised digital file format used in Singapore for GST audits, containing detailed transactional data from a business’s accounting system. It enables IRAS to efficiently review GST filings and assess compliance.

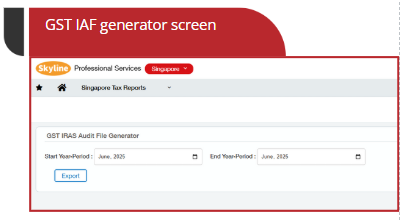

To generate the IAF file, navigate to Singapore tax reports ➔ GST IAF generator.

Select the period criteria and specify the output directory path to extract the IAF file.

The output for the IAF file will be in text file format with UTF-8 encoding.

The naming convention for the IAF file will be ‘IAF-Period_Criteria_of_report.txt’.

For Example – ‘IAF-20250601-20250630.txt’

Singapore GST Invoicing Format

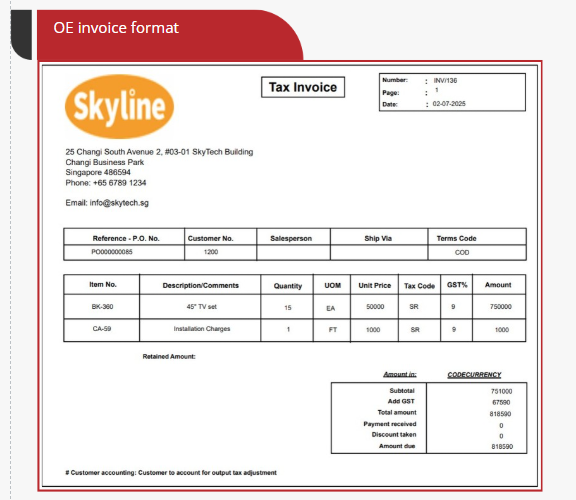

We provide out-of-the-box invoicing formats for the AR invoices (Service invoices) as well as Sales invoices.

To print the Singapore Tax invoicing format, open the transaction in AR/OE that you want to print, click on the ‘Print tax invoice’ button, and from the drop-down list, select the Singapore GST Format. The format names ending with SGGST represent the Singapore GST.

Our Singapore GST module, designed specifically for Sage Intacct, ensures accurate and automated GST calculations tailored to local compliance standards. Easily generate and export F5/F8 reports, IAF files, and tax invoice print formats with minimal effort. Seamlessly integrated with Sage Intacct, it streamlines your financial processes and reduces errors. Stay fully compliant with IRAS requirements while saving time and resources. Empower your business with a smart, reliable GST solution built for Sage Intacct.

Why Choose Singapore GST Module?

The Singapore Tax Reporting module for Sage Intacct helps businesses stay GST compliant by handling local sales, imports, exports, exemptions and zero-rated supplies.

It makes tax reporting easier, faster and IRAS-ready.

Seamlessly integrated with Sage Intacct, this module streamlines your financial processes & reduces errors.

Singapore GST module is designed specifically for Sage Intacct, ensuring accurate & automated GST calculations tailored to local compliance standards.

Seamlessly integrated with Sage Intacct, this module streamlines your financial processes & reduces errors.

Smart, Simple GST Compliance for Singapore

We provide out-of-the-box invoicing formats for the AR invoices (Service invoices) as well as Sales invoices.

To print the Singapore Tax invoicing format, open the transaction in AR/OE that you want to print, click on the ‘Print tax invoice’ button, and from the drop-down list, select the Singapore GST Format. The format names ending with SGGST represent the Singapore GST.

Our Singapore GST module, designed specifically for Sage Intacct, ensures accurate and automated GST calculations tailored to local compliance standards. Easily generate and export F5/F8 reports, IAF files, and tax invoice print formats with minimal effort. Seamlessly integrated with Sage Intacct, it streamlines your financial processes and reduces errors. Stay fully compliant with IRAS requirements while saving time and resources. Empower your business with a smart, reliable GST solution built for Sage Intacct.

UNLEASH YOUR TEAM’S PRODUCTIVEPower

We Enjoy Working

What People Say